South Australian Government supports local recycling with landfill price signals

By Mike Ritchie – Director, MRA Consulting Group

The decision to increase the levy to $103/t over 4 years will send a strong pricing signal to recyclers and waste generators in South Australia. To recyclers it is a signal to invest in new services and infrastructure and to grow jobs. To waste generators it is a signal to improve ‘at source’ separation of materials for recycling and to reduce waste to landfill.

The decision to increase the levy to $103/t over 4 years will send a strong pricing signal to recyclers and waste generators in South Australia. To recyclers it is a signal to invest in new services and infrastructure and to grow jobs. To waste generators it is a signal to improve ‘at source’ separation of materials for recycling and to reduce waste to landfill.

The secondary benefit of the levy increase, is the funds it will generate.

I am pleased to see that the SA government has agreed to hypothecate most of the funds to new infrastructure and recycling initiatives. The rest is being used to fund EPA programs.

It is now clear that landfill levies are one of two key drivers of waste reform in Australia (the other being regulation). It is also clear that the waste industry is now overwhelmingly in favour of levies as a mechanism to drive recycling and to achieve State Government recycling targets.

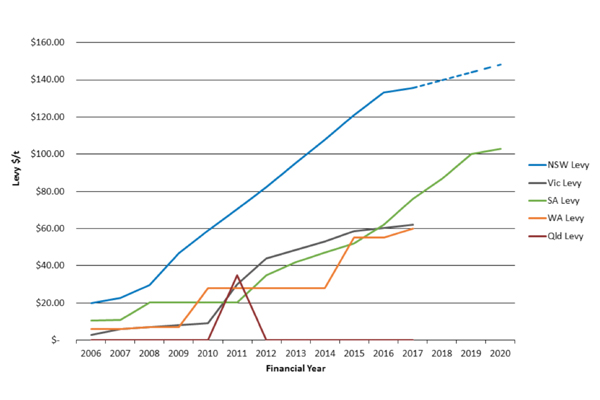

As shown on Figure 1, NSW and SA will now have levies over $100/t while Vic, WA and the ACT have levies around $60/t (ACT’s levy is imbedded in the Mugga lane landfill gate fee).

Figure 1. Historical and planned landfill levies per State

At present we have the ridiculous situation where over 400,000 tonnes per year of waste is sent from Sydney (where landfilling a tonne of waste costs over $300) to QLD to take advantage of the hyper cheap landfill around Brisbane ($10-35/t). It is very economically rational for the waste companies to arbitrage this failure in government policy making. In fact, the only thing saving Tasmania is Bass Straight.

Hopefully, the QLD and Tasmanian governments now see the SA action as a spur to introduce their own recycling price signals.

The widely different landfill costs in different States create market distortions, dilute the capacity of recyclers to compete with landfill and limit the job creation potential of investment in infrastructure and new recycling services.

When QLD had a $35/t levy recycling grew rapidly. In 2012 when the incoming Newman State Government withdrew the levy, recycling rates plunged by 18% and have not recovered since.

More broadly we need to reallocate the net burden of taxation from State taxes on employment (payroll tax) and housing (stamp duty) towards taxes that have positive social and environmental outcomes and yet raise funds for government services. Landfill levies are designed to limit the wastage of resources and provide real price signals for recycling. They create jobs and positive investment. They also raise real money for government.